Dairy Trade in Ethiopia: Current Scenario and Way Forward-Review- Juniper Publishers

Journal of Dairy & Veterinary Sciences- Juniper Publishers

Abstract

This review is concern on dairy trade in Ethiopia,

current scenario and way forwards for enhancing dairy investment of

Ethiopia. Consumers in Ethiopia come to be through formal and informal

marketing system. The country spent over 678.75 million birrs to import

various products of milk from 2006-2010 and the expenditure for powdered

milk accounted for 79.6%, followed by cream, 12.9% and cheese 4.3%.

Milk and its products market have changed significantly with strong

global growth stemming in from the presence of evermore consumers in

developing countries. To achieve the demand of milk and milk products in

Ethiopia, it should be improve the genetic potential of dairy

animal/cow- this could be through put in on genetic improvement on dairy

animals, encouraging forage and fodder production and trade, establish

agro-processing oil crops and use of by-products for animal feed,

improving the productive, reproductive and weight gain performance of

crossbreds, through enhanced provision of animal health services and

better feed.

Keywords: Dairy Trade; Development policy; Milk market

Abbreviations:

WTO: World Trade Organization; DDA: Dairy Development Agency; NFDM:

Nonfat Dry Milk; DDE: Dairy Development Enterprise; DMY: Daily Milk

Yield; WMP: Whole Milk Powder; SMP: Skim Milk Powder; GATT: General

Agreement on Tariffs and Trade negotiations; LOD: Limit Of

Determination; HACCP: Hazard Analysis Critical Control Point; DDMP:

Dairy Development Master Plan; ADLI: Agriculture Development Led

Industrialization; PRSP: Poverty Reduction Strategy Program; FSS: Food

Security Strategy; RDPS: Rural Development Policy and Strategies; CBSP:

Capacity Building Strategy and Program; AMS: Agricultural Marketing

Strategies; IFD: Improved Family Dairy; BDS: Business Development

Services

Introduction

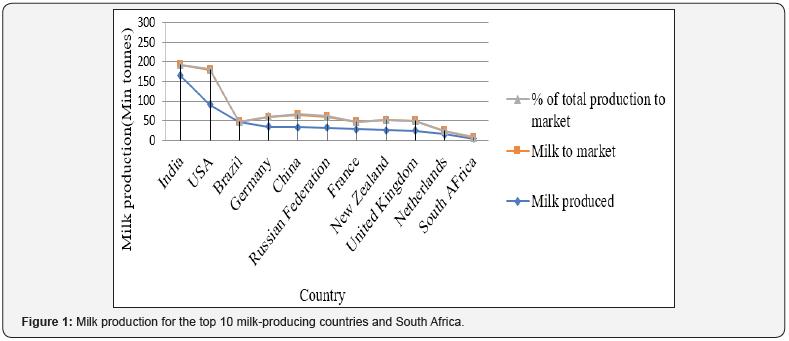

World trade in dairy products has grown in recent

decades at rates that generally exceed demand growth in developed

countries which produce most the world’s dairy products [1]. In the

world total milk production and trade is 816.0 and 73.2 million tones,

respectively [2] (Figure 1). Milk and dairy products market have changed

significantly with strong global growth stemming from the presence of

evermore consumers in developing countries. The

statistics showed a process of industrialization in the dairy chain

with the marked presence of large national companies developing

on the international scene and which also tend to concentrate

the market [3]. Total world dairy exports grew by 4.6% per year

on a milk equivalent basis during 2010–2014 [1] and the milk

production also grew up 2.4% in 2014 a rate like previous years

reaching 792 million tons. This is related with a favorable milk

production outlook in most of the major exporting countries and

continuous strong demand [4].

Ethiopia has one of the largest livestock inventories in Africa

with a national herd estimated cattle population in Ethiopia is

about 57.83 million, 28.04 million sheep, 28.61 million goats, 1.23

million camel and 60.51 million poultry. Out of 57.83 million cattle

the female cattle constitute about 55.38% (32.0 million) and the

remaining 44.55% (25.8 million) are male cattle. From the total

cattle in the country 98.59% (57.01million) are local breeds and

remaining are hybrid and exotic breeds that accounted for about

1.19% (706,793) and 0.14% (109,733), respectively [5]. Ethiopia

holds large potential for dairy development particularly Ethiopian

highlands possess a high potential for with diverse topographic

and climatic conditions favorable for dairying [6]. Smallholder

dairy farms in Ethiopia particularly in regional and zonal cities

are alarmingly increasing because of high demand of milk and

milk product from resident. However, the existing farming system

which holds maximum of 10 or 15 cows per individual is not

satisfactory to fulfill the demand. In addition, farming system

has a major problem with regards to feed source, feed supply

and the amount given per animal below the minimum standard,

which entails in reduction in production and reproduction in the

farms [7]. Livestock play a vital role in economic development;

particularly as societies evolve from subsistence agriculture

into cash-based economies [8]. Livestock in Ethiopia perform

important functions in the livelihoods of farm owners, pastoralists

and agro-pastoralists.

Dairy products in Ethiopia are channeled to consumers

through formal and informal marketing systems [9]. The formal

marketing system appeared to be expanding during the last

decade with private farms entering the dairy processing. The

informal market directly delivers dairy products by producers to

consumer (immediate neighborhood or sales to itinerant traders

or individuals in nearby towns). Generally, the low marketability

of milk and milk products pose limitations on possibilities of

exploring distant but rewarding markets. Therefore, improving

position of dairy farmers to actively engage in markets and improve

traditional processing techniques are important dairy value chain

challenges of the country [10]. To develop dairy production

system of Ethiopia, dairy supply and marketing system needs

to undertake radical changes. To get access to distant markets

farmers need to link up with manufacturers able to extend the

shelf-life of farmers’ supply, as well as with traders and retailers,

which can ensure a capillary distribution of final products. In

short, dairy products cannot be expected to flow across Ethiopia

unless a supply chain, bridging rural supply and urban demand

is in place [6]. The country has not supplied the demand of milk

and milk products because of different problem. To solve the

problem or to increase the production of milk it should be focused

on the policy and trade. Therefore, the objective of this review is

to discuss on dairy trade in Ethiopia, current scenario and way

forwards for enhancing dairy investment of Ethiopia.

Dairy Trade Development in World

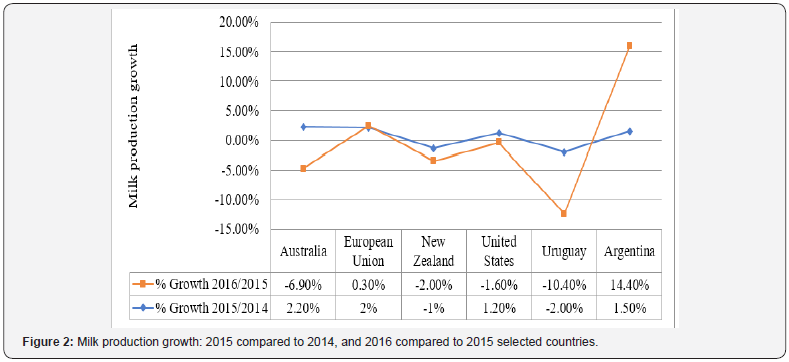

Global dairy consumption has been on the rise steadily since

2005 except for 2009 and 2015. Trade in a large quantity (46%)

of milk is informal [11] through short supply chains, and even

with the formal trade most milk does not cross currency borders.

The main reason dairy trade fell in 2009 was due to the global

financial crisis. In 2015, dairy trade dropped by weaker demand

for dairy commodities. The export subsidies received by European

Union’s dairy farmers from their government contributed to lower international dairy prices and a weaker demand for dairy

commodities (Figure 2). The increase in Europe’s dairy production

grew faster than consumption. Dairy imports grew in value from

$15 billion in 2005 to $43.2 billion in 2014, a 187% increase in

US dollars. Similarly, global dairy exports expanded 175% in value

from 2005 to 2014. The leading dairy importers from 2005 to 2009

were the United States, Mexico, Japan, Russia, and the European

Union-28. From 2010 to 2015, the situation changed as China

emerged as the world’s largest dairy importer followed by Russia,

the US, Mexico, and Japan. Although the demographic landscapes

of dairy consumption are changing globally, the major suppliers

of dairy commodities have remained relatively unchanged from

2005 to 2015. New Zealand is the world’s largest dairy exporter

in terms of volume. The four top global dairy exporters during the

observed period based on value are the EU–28, New Zealand, the

US, and Australia [12].

Over the last decade, interest in global dairy trade has

intensified partially because of the enormous impact that domestic

and international policies have had or are projected to have on the

global trade and domestic supply. One significant example in the

negotiations is the proposal made by the world trade organization

(WTO) during the Nairobi ministerial in December 2015 in

effort to help stabilize world dairy prices by eliminating export

subsidies over the next four years. While many dairy commodities

are traded internationally, some of the largest global exchanges

involve cheese, nonfat dry milk (including skim dry milk), whey,

and butter. In 2015 these four commodities accounted for 50% of

the total value of global dairy imports. Of all the dairy commodities

imported globally in 2015, cheese accounted for 24% of the total

value [13].

Global dairy demand is estimated at approximately 15 million

tons of product annually. The top 5 are China, Russia, Mexico, Japan

and the USA. The US is the only major importer that is also a major

net exporter. China imports ~2 million tons of dairy products

annually, Russia ~1.4 million tons, Mexico and Japan over 500

thousand tons each. In addition, the US, Indonesia, Philippines,

Saudi Arabia and Algeria import over 400 thousand tons and

Singapore, Iraq, Malaysia, Venezuela and UAE importing over

300 thousand tons annually. Ethiopia exported an amount less

than 300,000 USD per annum during the last five years. Majority

of the export destined to Somalia and traditional spiced butter

export for Ethiopian community and other consumers to USA

and other countries. With the expansion of the sector the volume

exported to Somalia can be increased and to other destinations

like Sudan, South Sudan and Djibouti can be expanded. Nonfat dry

milk (NFDM) was the second largest (in value) dairy commodity

imported making up 11% of the world’s total dairy imports in

2015. The import value of NFDM grew by 96% from 2010 to 2014

and the top importers in 2015 included Mexico, China, Indonesia,

and Malaysia. Whey and butter were the third and fourth largest

dairy commodities imported, respectively. Both whey and

butter balanced out at 7% of the total value of dairy imported

in 2015. Over the five-year span from 2010 to 2014 the value of

global imports of whey and butter increased by 81% and 62%,

respectively. The world’s leading importers of whey are China, the

US, and Indonesia, while Russia, Iran, and China are the leading

importers of butter [14].

Dairy Production Development History in Ethiopia

Before started formal dairy production in early 1950s, dairy

production in Ethiopia in the first half of 20th century was mostly

traditional [2]. In 1947 the country has received 300 Friesian and

Brown Swiss dairy cattle as a donation from the United Nations

Relief and Rehabilitation Administration [15] to attempt the

modern dairy production. With the introduction of these cattle in

the country, commercial liquid milk production started on large

farms in Addis Ababa and Asmera [16] and a small milk processing

plant was established in Addis Ababa to support commercial dairy

production [17]. During the second half of 1960s, dairy production

around Addis Ababa began to develop rapidly due to demand

and large private dairy farms and collection of milk from dairy

farmers [2]. In 1971 Government established dairy development

agency (DDA) to control and organize the collection, processing

and distribution of locally produced milk, and facilitated the

creation of dairy cooperatives to ease the provision of credit

and technical and extension service to dairy producers [6].

Distribution of exotic dairy cattle particularly Holstein Friesian

was done through government owned large-scale production such

as WADU, ARDU and CADU. These units produced and distributed

crossbred heifers, provided AI services and animal health service,

in addition to forage production and marketing [18]. To establish

the dairy development enterprise (DDE) numerous nationalized

dairy farms (include large dairy farms, milk collection networks,

and a processing plant) was merged in 1979 [17]. Distribution of

exotic dairy cattle particularly Holstein Friesian was done through

government owned large-scale production such as WADU, ARDU

and CADU. These units produced and distributed crossbred

heifers, provided AI services and animal health service, in addition

to forage production and marketing [18]. The development

of dairy sub sector is the shared effort of all stakeholders that

explicitly and implicitly participate in the different activities of

dairy development [19].

Currently, to bring market-oriented economic system, private

sector begun to enter the dairy sector and market as an important

actor the country’s policy reform. Many private investors have

established small and large dairy farms. This commercial farm use

grade and crossbred animals that have the potential to produce

1120-2500 litres over 279-day lactation. This production system

is now expanding in the highlands among mixed crop-livestock

farmers, such as those found in Selale, Ada’a and Holetta, and serves

as the major milk supplier to the urban market. Additionally, some

ten private investors and one cooperative union have established

milk-processing plants to supply fresh processed milk and dairy

products to Addis Ababa, Dire Dawa and Dessie towns. Most

interventions during this period was focused on urban-based

production and marketing. During the second half of the 1960s

dairy production in the Addis Ababa area began to develop rapidly

because of the expansion in large private dairy farms and the

participation of smallholder producers [6].

Dairy Production Systems in Ethiopia

Dairy production is practiced almost all over Ethiopia

involving a vast number of small subsistence and marketoriented

farms [20,21], and is being practiced as an integral part

of agricultural activities in Ethiopia since a time of immemorial.

There are different types of milk production systems identified

based on various criteria [22]. Based on climate, land holdings and

integration with crop production as criterion, the dairy production

system classified as rural (pastoralism, agro-pastoralism and

highland mixed smallholder), peri-urban and urban [9,20,21,23].

The dairy sector in Ethiopia can also be categorized based on

market-orientation, scale, and production intensity into three

major production systems: traditional smallholder, private/ stateowned

commercial4, and urban/ peri-urban [6].

Smallholder and commercial dairy farms are emerging mainly

in the urban and peri-urban areas are located near or in proximity

of Addis Ababa and regional towns and take the advantage of

the urban markets. Urban dairy production system includes

specialized, state and businessmen owned farms, but owners have

no access to grazing land [24-26] and most Regional towns and

Woredas [27]. Urban milk system in Addis Ababa consists of 5167

small, medium and large dairy farms producing 34.65 million

liters of milk annually. Of the total urban milk production, 73% is

sold, 10% is left for household consumption, 9.4% is fed to calves

(excluding the amount directly suckled by the calves) and 7.6% is

processed into butter and cottage cheese. In terms of marketing,

71% of the producers sell milk directly to consumers and the rest

reaches to the consumers through intermediaries.

Peri-urban milk production system possesses animal types

ranging from 50% crosses to the high-grade Friesian in small

to medium-sized farms. The peri-urban milk system includes

smallholder and commercial dairy farm owners in the proximity

of Addis Ababa and other Regional towns. This sector owns most

of the country`s improved dairy stock. The main source of feed is

both homes produced or purchased hay; and the primary objective

is to get additional cash income from milk sale. This production

system is now expanding in the highlands among mixed croplivestock

farm owners such as those found in Selale and Holetta

and serves as the major milk supplier to the urban market [28].

The rural system is non-market oriented and most of the milk

produced in this system is retained for home consumption

and usually marketed through the informal market after the

households satisfy their needs.

Milk Yield and Consumption Pattern

Most dairy products in the world are consumed in the region or

country in which they are produced because of milk and its various

derivatives are highly perishable products [29]. The estimate of

total cow milk production for the rural sedentary areas of Ethiopia

is about 3.06 billion liters [5]. The average daily milk yield (DMY)

performances of indigenous cows in PLWs was 1.85 litres/day and

ranged from 1.24 liters in rural lowland agro-pastoral system of

Mieso to 2.31 litres in rural highland dairy production system of

Fogera [30]. For hybrid cows, milk production per day per cow of

8 to 10 liters while their hybrid cow’s milk production per day is

11 to 15 liters [31]. In addition, the overall mean daily milk yield

per liter per cow in western Oromiya were 2.2 ±0.6 and 6.5 ±1.6

for local and dairy breed [32]. Moreover, average daily milk yield

of cross bred and local cows in Sululta were 9.56 ± 3.010 and

1.809 ± 0.4574 liter/day respectively. Moreover, the milk yield for

crossbred and local cows in Wolmera areas were 8.60 ± 2.703 and

1.96 ± 0.8193 liters/day, respectively [33].

Currently Ethiopia’s milk consumption is only 19 liters per

person 10% of Sudan’s and 20% of Kenya’s – but urbanization is

driving up consumption per capita consumption in Addis Ababa

is 52 liters per person [34]. The average expenditure on milk

and products by Ethiopian household’s accounts for only 4% of

the total household food budget. According to CSA [5] reported,

from the total annual milk production, 42.38% used for household

consumption, 6.12% sold, only 0.33% used for wages in kind and

the rest 51.17% used for other purposes (could be to produce

butter, cheese, and the likes). In rural area 59% and 41% of dairy

farmers in Ada’a district, east Shawa zone sold raw milk through

informal and formal milk marketing channels, respectively [35],

but the finding of Valk & Tessema [36] is 98% of milk produced

in rural area sold through informal chain whereas only 2% of

the milk produced reached the final consumers through formal

chain. According to Geleti & Eyassu [37,38] reported, there is no

well-organized milk marketing system in Nekemte and Bako milk

shed, and Dire Dawa. Dairy co-operatives and milk groups have

facilitated the participation of smallholders in fluid milk markets

in the Ethiopian highlands.

In Ethiopia, most consumers prefer unprocessed fluid milk

due to its natural flavor (high fat content), availability, taste

and lower price. Milk consumption in Ethiopia shows that most

consumers prefer purchasing of raw milk because of its natural

flavor (high fat content), availability and lower price. Ethiopians

consume fewer dairy products than other African countries and

far less than the world consumption. The present national average

capita consumption of milk is much lower, 19kg/year as compared

to 27kg for other African countries and 100kg to the world per

capita consumption [39]. The recommended per capita milk

consumption is 200 l/y. The consumption in Addis Ababa is very

high (51.85 litres) as compared to the national and other towns.

Indian milk production grew by 4.5%, Pakistan by 1.8%, Germany

by 1.2%, and the USA by 1.1%. Brazil’s milk production decreased

by 2.8% and New Zealand by 1.3% [40]. Generally, the demand

for milk and milk products is higher in urban areas where there

is high population pressure. The increasing trend of urbanization

and population growth leads to the appearance and expansion of

specialized medium-to-large scale dairy enterprises that collect,

pasteurize, pack and distribute milk to consumers in different

parts of the country [41].

Domestic and Export Market of Milk and Milk Product

Milk is channeled to consumers through formal and informal

marketing systems [42]. The informal market involves direct delivery of milk by farmers to individual consumers in immediate

neighborhood and sales to travelling traders or individuals in

nearby towns. In informal market, milk may pass from producers

to consumers directly or it may pass through two or more market

agents. Ethiopia is not known to export dairy products; however,

some insignificant quantities of milk and butter are exported to

a few countries. Butter is mainly exported to Djibouti and South

Africa (targeting the Ethiopians in Diaspora), while milk is solely

exported to Somalia from the South Eastern Region of the country.

As indicated by small quantities of cream are exported to Djibouti

from Dire Dawa. The choice of targeting either domestic or export

markets in the process of smallholder commercialization is

basically linked to the nature of the targeted commodities [43].

For countries with large population size, domestic markets could

also be a major market target due to higher domestic demand for

both staples and high-value commodities [44]. In targeting the

export market for the process of smallholder commercialization

the issue of product quality, sanitary and phytosanitary standards,

timely and regular supply, and volume need to be given emphasis

in enabling the small-scale farmers to be part of the game [45].

The country spent over 678.75 million birrs to import various

products of milk from 2006-2010. Expenditure on powdered

milk accounted for 79.6%, followed by cream, 12.9% and cheese

4.3% [46]. With Ethiopia already spending approximately $10

million annually in foreign powdered milk imports, there is a huge

opportunity for domestic UHT production to disrupt the current

market. Investment size A $10-11 million greenfield investment

would create a UHT plant with the largest processing capacity in

the Ethiopian market Capacity 10,000 liters/hour (80,000 liters/

day, 24 million liters/year employment 500-600 employees

estimated return IRR of 25-35% over 5 years.

International Market (Import Vs Export) in Milk and Milk Products

Only about 66.5 million tons or 8.3% of total world dairy

production is traded internationally, excluding intra-EU trade.

Dairy trade volumes increased by 6% from 2013 to 2014 compared

to 2% growth between 2012 and 2013. International prices of

all dairy products continued to decline from their 2013 peak for

skim milk powder (SMP) and whole milk powder (WMP). A key

factor was the decline in Chinese import demand, with demand

for WMP dropping by 34% from 2014 levels. This decrease in

Chinese demand for dairy products was coupled with continued

production growth between 2014 and 2015 in key export markets,

with total output of milk increasing in Australia (4%), European

Union (2%), New Zealand (5%) and United States (1%) [47]. At

global level demand for milk and milk products in developing

countries is growing with rising incomes, population growth,

urbanization and changes in diets. This trend is pronounced in

East and Southeast Asia, particularly in highly populated countries

such as China, Indonesia and Vietnam. The growing demand for

milk and milk products offers a good opportunity for producers

(and other actors in the dairy chain) in high-potential, peri-urban

areas to enhance their livelihoods through increased production.

Global milk production is estimated at approximately 735 billion

litres annually.

General Agreement on Tariffs and Trade negotiations (GATT),

followed by those of the world trade organization (WTO) changed

in the sense of liberating trade from all public intervention. A

structural change in the shape and form of the main exporters

and importers has taken place on the international dairy scene

following this freeing-up of the market. International trade in milk

and dairy products has exhibited quite large fluctuations over the

last few decades, resulting in changes to public policies in western

countries and their decisions stop subsidizing products. Significant

growth in exports as well as imports of fresh drinking milk

(whole and/or skimmed), milk powder (whole and/or skimmed),

condensed whole milk and evaporated milk between 1960 and

2010. The European Union accounts for the largest share in total

volume of exported and imported milk, even though its average

annual rate of growth over the 25 years studied was just 0.25%.

Worldwide new EU members, Oceania and Latin America have

increased their share of total exported volumes. Milk production

in 2015 was 6.4% higher than in 2014. In 2015 South Africa

imported 69 354 t of dairy products, up 72.5% on the same period

the previous year, and exported 61 296 t of dairy products, 13.8%

down on 2014. International dairy product prices continued the

extreme volatility and downward trend experienced since 2014

[48].

Technological developments in refrigeration and transportation

only 7% of the milk produced are traded internationally if intra-

EU trade is excluded. Trade in dairy products is very volatile as

dairy trade flows can be affected by overall economic a situation

in a country fluctuation in supply and demand, changing exchange

rates and political measures. With demand for dairy products

most rapidly rising in regions that are not self-sufficient in milk

production, volumes of dairy trade are growing. Also, the share of

global dairy production that is traded will increase as trade will

grow at a faster pace than milk production. The developed countries

account for 62 percent of the world’s dairy imports (measured

in milk equivalents) and 93% of the exports, showing clearly

that the major part of the global dairy trade takes place among

developed countries [49].

International trade requirements for dairy

The international market for dairy products currently

is

far from having a single multinational processing firm [50].

Milk is perishable nature of dairy products, hygienic measures

including heat treatment and cold storage are required to prevent

hazardous bacterial contamination. By subjecting veterinary

drugs and pesticides to strict authorization requirements,

undesirable residue accumulation in dairy products is minimized.

Other residues or contaminants, including diverse persistent

environmental pollutants can accumulate in milk fat. Ensuring

low levels of such pollutants in milk products requires adequate

environmental protection. In the case of residues and contaminants

that may constitute a danger to public health, regulations will set

the maximum residue levels that are permitted in foodstuffs [51].

Especially in developing countries, but not exclusively there, it can

be very difficult for farmers to meet private standards for milk

quality and safety which might require investment in mechanical

milking, on farm cooling, new feeds and genetic improvement.

Apart from the initial investment cost a dairy farmer faces to meet

those standards, also high operating costs might render small and

even medium-scale units unprofitable in the long run.

There is different sanitary regulation apply both to dairy

products and to the production processes. Regulation, which

can be a mix of international recommendations and national

legislation, is often dynamic. Regulation often is reactive:

outbreaks of BSE in the UK and the associated fatalities of variant

CJD in humans were followed by increased regulation of livestock

products. In addition, rules develop in response to new scientific

findings, albeit with a lag.

a. Sanitary product standards set targets for test results, and

generally are composed of a maximum level of pathogenic load or

contamination and the method for measurement. Micro bacterial

standards apply to the dairy product as well as the raw milk inputs

and are often measured by plate counts and cell counts. Tolerance

levels also apply to contaminants such as residues of antibiotics

or other veterinary medicine, mycotoxins and other ‘natural’

contaminants, or concentrations of food additives or pollution.

Tolerances are set based on toxicological and epidemiological data

that show effects on the health of humans and animals. The lower

bound of a tolerance level is set by the limit of determination

(LOD), which is the lowest possible concentration that can be

picked up in a test. Due to the continuous progress of science and

laboratory analyses, the LOD is continuously decreasing over time

and moving ever closer to zero.

b. Process standards are used as a benchmark to judge

whether a food has been produced in a manner to be fit for human

consumption or trade. There are various required practices

to ensure hygienic conditions of holdings and milk collection,

processing plants, storage, and transport. Often, hygiene

requirements demand a quality management scheme, such as

hazard analysis critical control point (HACCP). A second important

set of process standards applies to the health of the dairy cattle.

c. Conformity assessment is the provision of guarantees

that the processes of hazard monitoring and control in the export

firm are at least equivalent to those demanded by the importing

country. The importing country has three mechanisms for

enforcing that dairy shipments indeed meet its legal requirements:

through certification, prior approval of handlers, and testing of the

end-product.

Development Policy and Strategy

The current rural development policy and strategy of the

country has some provisions indicating general direction for

livestock development. Dairy Development Master Plan (DDMP)

was formulated in 2002 to guide the sub-sector development and

has been implemented since then across the regions. The DDMP

highlights input and output targets but fails short of indicating

roadmap and providing guidelines and principles to inform

actual policy implementation on the ground. The uniqueness

of each area means policy and development interventions must

be customized. Whilst general guidelines and principles can be

designed at national level, it is neither possible nor appropriate

to design a master plan and implement throughout the country,

or even throughout a province. Improving economic incentives to

encourage innovations; pursuing value chain approach; providing

public support to private sector development and private-public

partnership; engaging in a holistic approach to technological

innovations for increasing supply response; formulating policy and

strategy to guide the sub-sector development, and strengthening

capacity in local innovation systems with milk value chain

perspective as strategic options for consideration by the relevant

actors and stakeholders [52].

Trends in Development of the Dairy Sector in Ethiopia

Global milk production has been strong over the last several

years leading to expanded growth in trade in most years with

a sudden drop off in 2015. For example, from 2005 to 2013,

the world milk production increased more than 16% [53]. An

average of 594.4 million metric tons of cow milk was produced

throughout the world over the observed nine-year period. The

six major milk suppliers, the EU–28, the US, India, China, Russia,

and Brazil accounted for more than 80% of the world’s cow milk

production during the last four years EU–28 is the world’s largest

milk producer, the greatest growth in milk production among the

top six milk suppliers occurred in India and China. India’s cow

milk production grew 15.3% from 2012 to 2015, while China

production expanded by 15.1% Brazil milk production grew by

14.3%. Global dairy production is expected to continue to increase

soon as world GDP raises and consumers’ preferences for different

types of dairy products expand.

Opportunities and Challenges in Dairy Production Development in Ethiopia

Opportunities

Ethiopia holds large potential for dairy development due to

its large livestock population, urbanization, emerging middle class

consumer segments that are willing to embrace new products and

services, demand for and consumption of milk, positive economic

outlook, livestock genetic resources and production system,

expected to increase processed dairy products consumption

favorable climate for improved, export and foreign market

possibility (Somalia, Sudan, South Sudan and Djibouti are potential

foreign markets), indigenous knowledge, income generation and

employment, and the relatively disease-free environment for

livestock. In addition, the purchasing power increase, population

growth and consumer awareness will increase the demand

for quality, volume, graded and standardized products and

traceability of sources. Land O’ Lakes in 2010 showed that the top

10% earners in Addis Ababa consumed about 38% of milk, while

the lowest income group, approximately 61% of the population

consumed only 23%.

Challenges

In Ethiopian the major constraints for dairy sector are

shortage of feed at the end of dry, land shortage for establish

improved forage, genetic limitation, limited access and high cost

of dairy heifers/cows absence of an operational breeding strategy

and policy, inadequate veterinary service provision, weak linkages

between research, extension service providers and technology

users, inadequate extension and training service, milk market

related constraints, reproductive problems, lack of research and

information exchange system, lack of education and consultation,

socio-economic challenges and limited availability of credit to the

dairy farmer.

Dairy marketing is a key constraint to dairy development

throughout Sub-Saharan Africa. Marketing problems must be

addressed if dairying is to realize its full potential to provide food

and stimulate broad based agriculture and economic development.

Because dairy development is sources of employment since it

is labor intensive and associated with large incomes and price

elasticity of demand. There is also risk of price decrease to

suppliers related to dairy imports and food aid, and seasonal fall

in demand due to cultural conditions. Adulteration is also believed

to be a problem especially among the smallholders. Therefore, to

increase milk productivity, it is necessary to eliminate the limiting

factors and in turn exploit opportunities that could improve

productivity of milk [54].

Major Trade Barriers to Dairy Products

Milk and dairy products are considered high-risk goods in

production, consumption and trade. The risks, or perceived risks,

are that milk products pose threats to food safety and animal

health. As a result, dairy trade is subject to a considerable amount

of regulation to limit the transfer of risk. Whereas such sanitary

measures are generally applied for legitimate reasons, they can

also be used in a protectionist manner, and such tendencies might

increase with the further lowering of tariffs and expansion of tariff

rate quotas [55]. High tariffs effectively block certain markets for

exports or place severe restrictions through limited levels of quota

access, high trade restrictions, combined with domestic support

for dairy production, are common in the largest dairy markets

such as Canada, the US, the EU and Japan. These trade restrictions

are a key reason why only 7% of global dairy production is traded.

Trade in dairy is expected to increase due to the rising demand for

dairy products in emerging and developing markets.

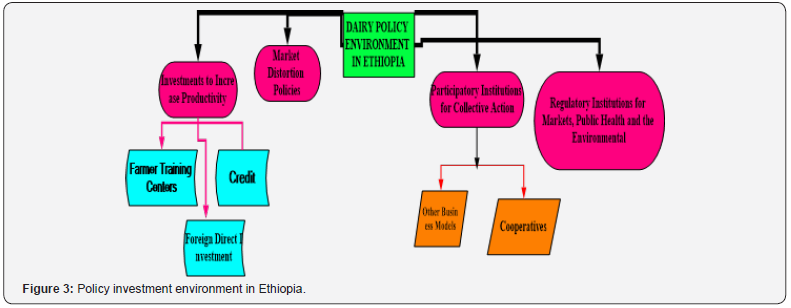

Dairy Investment Policy Environment in Ethiopia (Figure 3)

The policy and regulatory environment influenced the

country’s dairy sector characterized as free market economic

system and the emergence of modern commercial dairying (1960

- 1974), socialist (Derg) regime that emphasized a centralized

economic system and state farms (1974 - 1991) and free market

and market liberalization (1991- present). The major goal of

livestock policy programmed is to increase smallholders’ returns

from investments in animal agriculture by providing them with

essential information on government policies in the sector and

developing appropriate policy and institutional options that will

help improve livestock productivity, asset accumulation, promote

sustainable use of natural resources and building capacity of

policy makers and analysts [56]. Investment in dairy cattle

breeds improvement in the MRS system through crossbreeding

using AI and synchronization. For the five-year GTP II period,

a total investment of ETB 148 million is needed to improve the

capacity of the AI centers and the related service, and the training

of AI technicians. The investment by the GoE to put in place the

AI and synchronization services for the intervention is only

ETB 148 million (very good leveraging by the GoE). Average

milk production per crossbred cow per day in small specialized

dairy increases from 10 to 12 litres (20% increase), in medium

specialized dairy increases from 16 to 19.2 litres (20% increase),

in small specialized dairy units increases from 2593 to 2746 litres

(6% increase) and in medium specialized dairy units increases

from 4608 to 5080 litres (10% increase) are the improvement

objective crossbred dairy cattle in specialized dairy with the

adoption of the interventions during the GTP II [57].

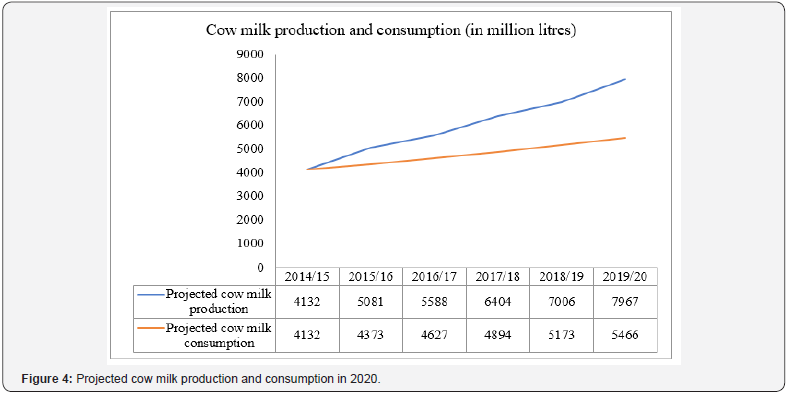

To meet the targets projected for 2020 government policy is important to create an environment conducive for innovation

and risk taking on the part of investors (Figure 4). Delgado [58]

identify four policy pillars for commercialization of smallholder

dairying

a. Remove market distortions

b. Building participatory institutions of collective actions

by small producers to facilitate their vertical integration

c. Increasing investment to improve productivity

d. Promoting effective regulatory institutions to deal

with public health and environmental concerns of livestock

intensification.

Current Scenario and Way Forward

The prospects of dairying seem to be bright because government

is attempting them remedy through policies and strategies. Thus,

dairy farmers are on the way to getting access to services and

inputs that could help promote dairy production and productivity.

This mainly includes feed and feeding, breeding services,

credit, extension, training, veterinary services, and appropriate

marketing system that addresses consumers’ demands etc. Since

dairying is labor intensive, it promotes the motto of government

policy in creating employment opportunities at house hold level.

This improves employment, income and nutrition values of the

family of the producers and the other demanders/consumers.

The dairy industry would address and serve as one of the major

instruments of the governments’ policy in achieving food security.

This in turn promotes dairy production due to the attention of

given by the government [59-63]. According to the 2014 GDP per

capita statistics 0.4% of the population has consumption of 10-20

USD/day, 4.3% of the population 4-10 USD/day and 24.6% of the

population 2-4 USD/day per capita. With the increase in income,

it is expected that consumption pattern shifts to high value food

items that demands encouraging supply of livestock products.

The contribution of medium specialized dairy to GDP increases

from ETB 353 million in 2015 to ETB 751 million in 2020. Milk

trade in the dry lands, which is concentrated near towns, there

is greater involvement of poorer herders, especially women than

there generally is for live animal trade. However, opportunities for

dairy trade in the dry lands (especially commerce in cow milk and

butter) are limited mainly to urban and peri-urban areas where

consumers are available and distance to markets is minimal.

Livestock development is guided by the broad policies of the

government. These include the Agriculture Development Led

Industrialization (ADLI), Poverty Reduction Strategy Program

(PRSP), Food Security Strategy (FSS), Rural Development Policy

and Strategies (RDPS), Capacity Building Strategy and Program

(CBSP), Agricultural Marketing Strategies (AMS), foreign affairs

and security policy and strategy, the export strategy, and the draft

livestock breeding policy [64].

A future milk surplus could be realized through investment

in better genetics, feed and health services, improving both

traditional dairy farms and commercial-scale specialized dairy

production units. The investment interventions proposed to

improve cattle milk production and the value chain would

transform family dairy farms in the highland moisture enough

production zone from traditional to market-oriented improved

family dairy (IFD) systems. These proposed interventions would

also vastly increase the commercial-scale specialized dairy units as

well as improve milk production from indigenous (or local) cattle

breeds. Dairy co-operatives and Milk groups have facilitated the

participation of smallholder in fluid milk markets in the Ethiopian

highlands. Milk groups are a simple example of an agro-industrial

innovation, but they are only a necessary first step in the process

of developing more sophisticated co-operative organizations and

well-functioning dairy markets [65,66]. The survival of the milk

groups that supply inputs and process and market dairy products

will depend on their continued ability to capture value-added

dairy processing and return that value-added to their members.

Evidence from Kenya emphasizes the importance of milk

collection organizations in improving access to market and

expanding productive bases. On the other hand, there is a need to

stimulate consumption of dairy products in the country through

various mechanisms, including school milk programmed as

more consumption increase demand for dairy produce and can

potentially encourage production in the long run. By increasing

the number and productivity of cattle through improvements in

genetics, health and feeding, domestic cow milk production will

increase by about 93% by 2020, consumption demand will be

satisfied, and export of cow milk and milk products will begin.

The following points should be implemented to growth the

dairy trade

a. A clear understanding of potential market trends and

opportunities is needed for policy and planning in the dairy

sub-sector.

b. Public policy-makers should engage constructively with

traditional markets to link them with formal modern industry.

c. Make investment in dairy co-operative development

effective and pro-poor should be well managed, placed outside

strong political forces and linked to strong demand.

d. There must be a link between agricultural research

and growth in dairy development. Investment in dairy

development through provision of appropriate credit and

research technologies to smallholder producers will bring

growth and shift producers towards greater commercial

orientation, increasing their demand for improved

technologies and innovations [67].

e. Imports and exports as well as macro policy and level of

openness of the economy, can play a consistent role in the pace

of dairy sector development. Import controls/ restrictions

which is not for purposes of enforcing Sanitary Requirements

and Food Safety Standards should be reduced or abolished.

By so doing the role of domestic market protection will be

relegated to ratification of dairy products.

f. Ethiopia dairy industry currently lacks some categories

of products in terms of variety, quality and quantity. These

include; cheeses, butter, milk powder, whey, yoghurts and ice

cream. The processors can seek ways to increase capacity and

invest aggressively in product development.

g. The performance of the few milk producing co-operatives

operating so far has shown that the quantity of locally produced

milk currently available to processors and consumers could be

increased significantly if effective collection (quality controlplatform,

chemical and microbiological) tests, transportation,

cooling and marketing systems are put in place.

h. Milk producers’ organizations should provide ‘support

services’ to increase clean milk production. An effective and

well-trained animal health service should be available at

any time to look after the health of animals, arrangements

should be made for regular vaccination and checking against

contagious diseases by the qualified veterinarians.

i. Formation of Dairy Board at national level and regional

level are important for the development of the dairy industry

[68]. Introduction of programs that will increase milk

consumption (e.g. introduction of school milk program) price

differentiation (i.e. premium price for high quality milk) are

important for increasing milk production and consumption.

j. Addressing milk quality concerns and transforming

the informal milk markets based on the concept of business

development services (BDS), and be supervised by national

regulatory authorities

k. As in many African countries, knowledge of hygiene is

often not enough. Thus, the most important support services

regarding clean milk production is “Extension –Education”.

Conclusion and Recommendation

Conclusion

Only about 66.5 million tons or 8.3% of total world dairy

production is traded internationally, excluding intra-EU trade.

Even if the demand is estimated 15 million tons of product

annually, 816.0 million tons milk produced and the traded was

73.2 million tons. Over the last decade interest in global dairy

trade has intensified partially because of the enormous impact

that domestic and international policies have had or are projected

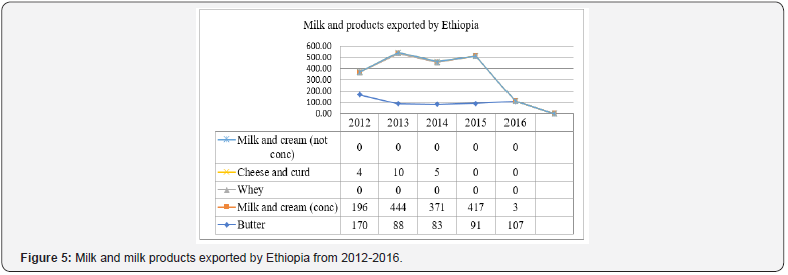

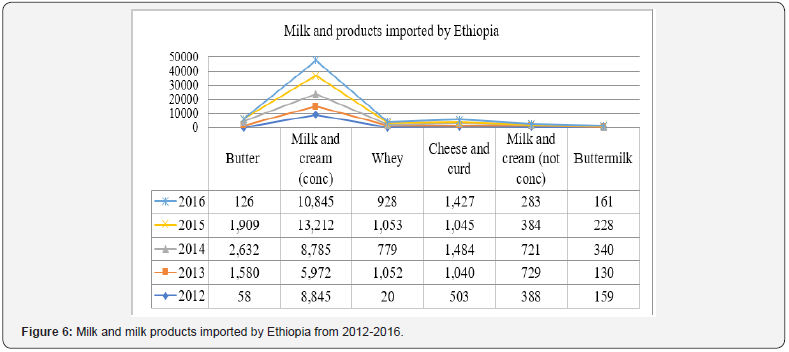

to have on the global trade and domestic supply. In 2012-2016

Ethiopia imported more milk and milk products than exported

(Figures 5 & 6). Though dairy sector in Ethiopia has a challenge,

there are potential to development. Imports and exports as well

as macro policy and level of openness of the economy, can play a

consistent role in the pace of dairy sector development.

Recommendation

a. Should be develop marketing channels which can be

used to promote the milk producers and dairy value chain

actors, aware of the potential for increased production and

marketing of specific products

b. Should be encourage licensed traders and qualitybased

payments, strengthen the coordination between

union, primary cooperatives and farmers and improve the

effectiveness

c. Improve HACCP knowledge and skills and ensure milk

producers, processors, transporters, retainers and collectors.

d. Dairy plants (like collection center, bulk cooling,

transport, processing and distribution) should be organized

to enhance formal marketing/trade

e. Should be set a clear market trends and opportunities

policy and planning in the dairy sector

f. Strengthen investment in dairy co-operative

development effective and pro-poor should be well managed,

placed outside strong political forces and linked to strong

demand

g. Should be encourage/develop quality control to increase

consumer knowledge and demand for specific products

h. Improve milk production efficiency can be important

through specific education and training

i. Improve milk production efficiency by investing high

dairy herd size and create free access for investors in larger

dairy farms with the best growth potential of livestock

selection service recording system and strengthening project

which supports investment and training in commercial dairy

farms.

j. Training should be provide by professional for

producers, dairy value chain actors, may include: skills and

know-how on marketing and branding products to identify

new opportunities at the dairy processing level; support

for research and development initiatives for new dairy

products; case studies and exposure to foreign experiences

might stimulate creativity and entrepreneurship at the dairy

processing level; a better understanding and a greater focus on

market-driven value chains; knowledge of the requirements of

food retailers is a precondition for the successful marketing

of their products, better knowledge about these requirements

may lead to opportunities for increased market participation;

developing intermediary support structures that bring

buyers and suppliers together is another initiative that can be

undertaken at local and national levels.

k. Should be build the trust within farm communities and

to improve awareness of the benefits of a more cooperative

approach in terms of bargaining power and marketing strategy.

l. Develop or improve the image of the dairy sector by

professionalizing the sector, to create better-quality jobs for

young, well-educated people, and professional farms and a

better marketing strategy for adding value, higher incomes

and a more attractive dairy sector. More emphasis must be

placed on a young and successful entrepreneur profile to

attract young people to the sector

Government should be fund for milk producers and investors

based on their project proposal

To know more about journal of veterinary science impact factor: https://juniperpublishers.com/jdvs/index.php

To know more about Open Access Publishers: Juniper Publishers

Comments

Post a Comment